Hey there, fellow taxpayers!

It’s that time of the year again!

April 15th is just around the corner, and you know what that means – it’s tax season! Time to gather all your documents, crunch those numbers, and fill out the necessary forms. Fortunately, the IRS has made the process a bit easier for us this year.

April 15th is just around the corner, and you know what that means – it’s tax season! Time to gather all your documents, crunch those numbers, and fill out the necessary forms. Fortunately, the IRS has made the process a bit easier for us this year.

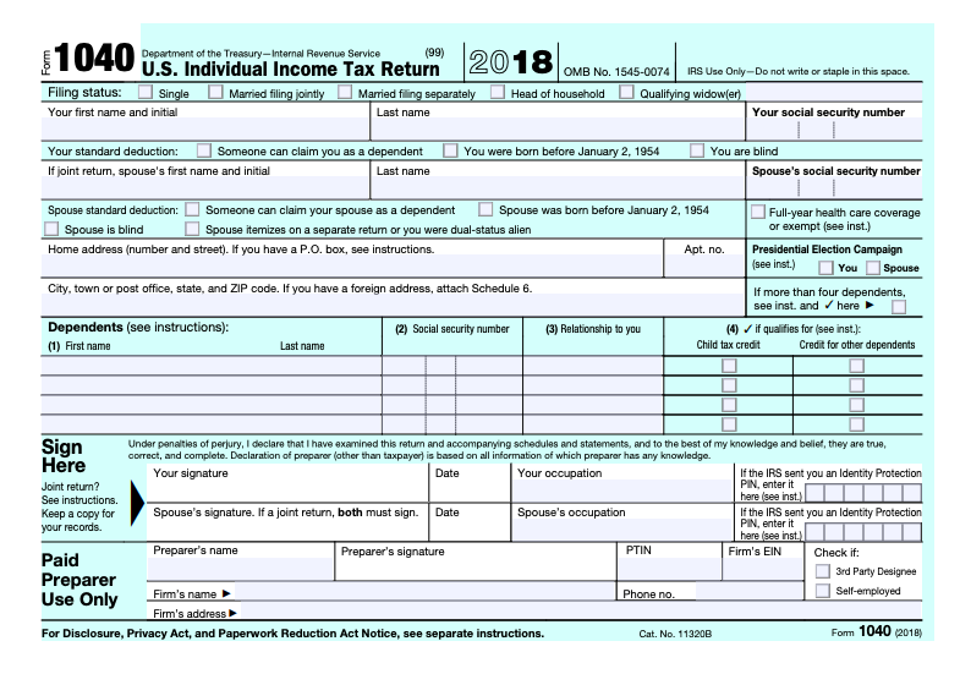

Introducing the New IRS Form 1040

The IRS has recently released a new, sleeker version of the Form 1040 for the year 2018. It’s not quite postcard-sized, but it’s definitely more concise and streamlined than before. The new design aims to simplify the tax filing process while still ensuring accuracy. So, get ready to say goodbye to the old and embrace this fresh change.

The IRS has recently released a new, sleeker version of the Form 1040 for the year 2018. It’s not quite postcard-sized, but it’s definitely more concise and streamlined than before. The new design aims to simplify the tax filing process while still ensuring accuracy. So, get ready to say goodbye to the old and embrace this fresh change.

But Wait, There’s More!

Aside from the Form 1040, there are a few other forms you might encounter during your tax preparation journey. Let’s take a look at some of them:

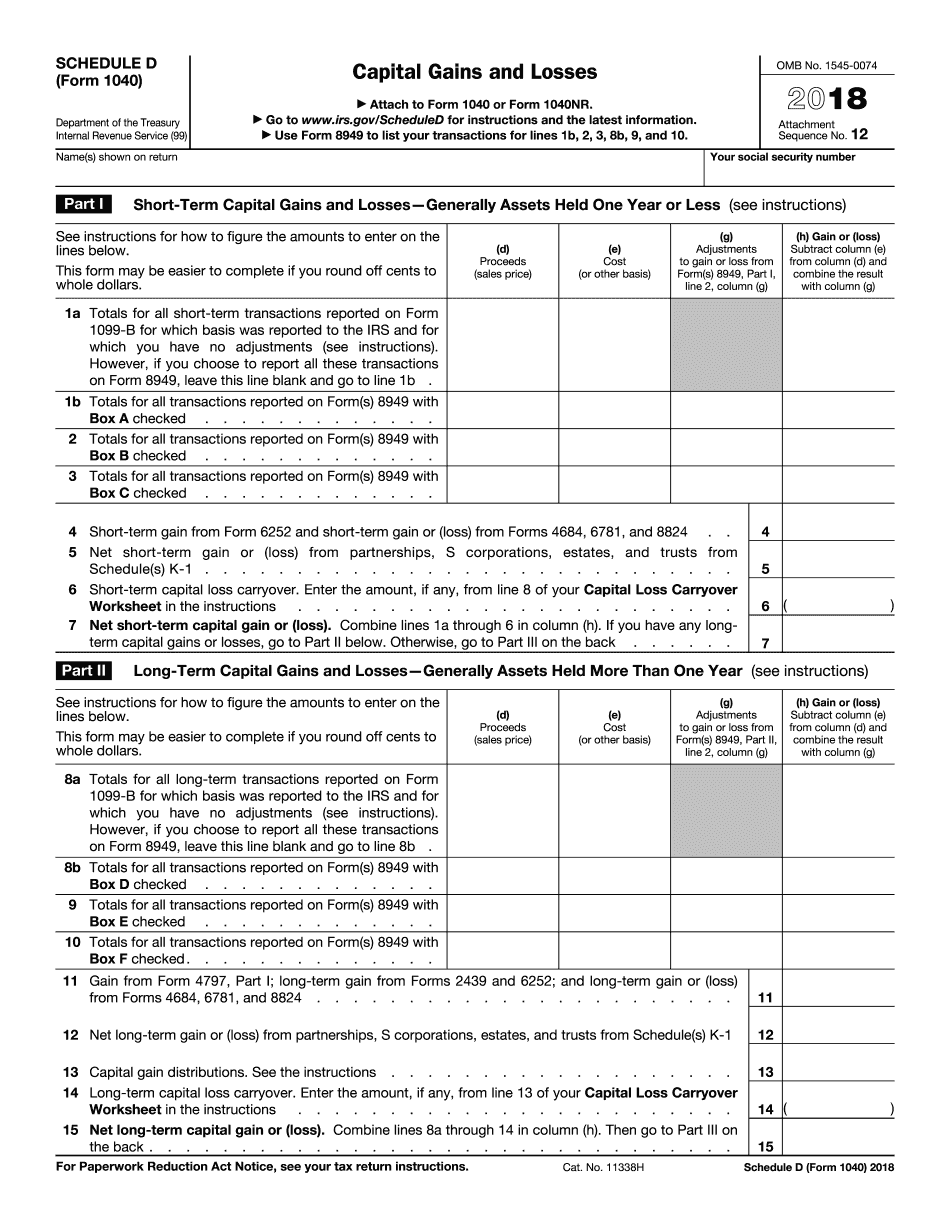

Form 1040 Schedule D

If you’ve made capital gains or losses throughout the year, you’ll need to fill out Form 1040 Schedule D. This form helps you report those gains or losses to the IRS and calculate the appropriate tax liability. It’s available in a fillable and editable PDF format for your convenience.

If you’ve made capital gains or losses throughout the year, you’ll need to fill out Form 1040 Schedule D. This form helps you report those gains or losses to the IRS and calculate the appropriate tax liability. It’s available in a fillable and editable PDF format for your convenience.

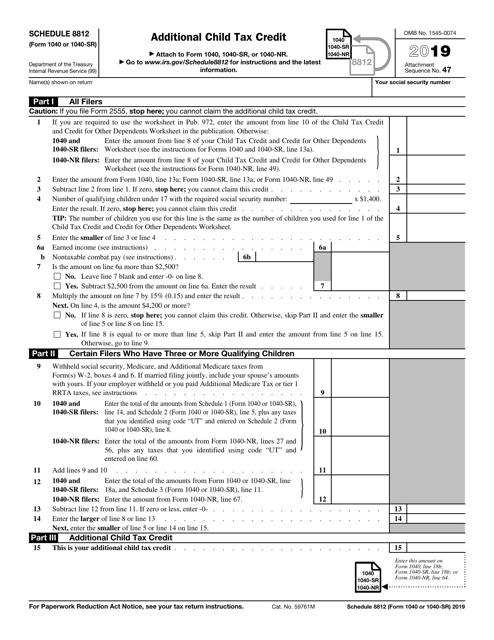

Form 1040 Schedule 8812

If you have children and qualify for the Additional Child Tax Credit, you’ll need to complete Form 1040 Schedule 8812. This form allows you to claim the credit and reduce your overall tax liability. Don’t miss out on this opportunity to maximize your tax savings!

If you have children and qualify for the Additional Child Tax Credit, you’ll need to complete Form 1040 Schedule 8812. This form allows you to claim the credit and reduce your overall tax liability. Don’t miss out on this opportunity to maximize your tax savings!

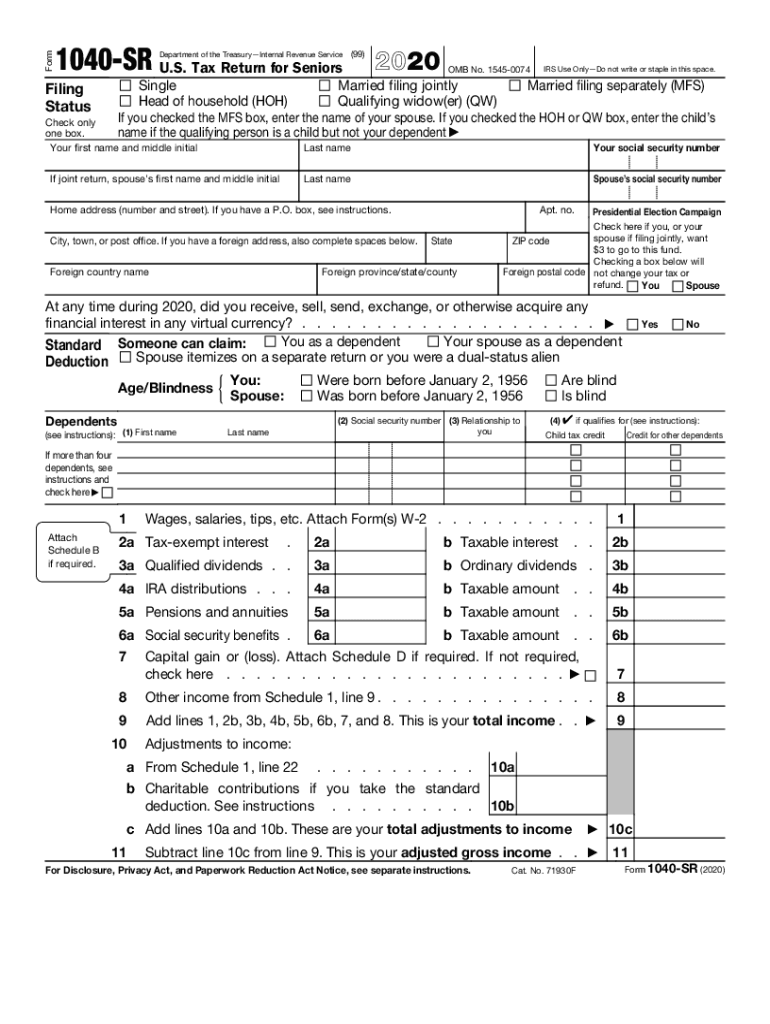

Form 1040-SR

For our wonderful senior citizens out there, the IRS has introduced Form 1040-SR. This form is specifically tailored to meet the needs of taxpayers aged 65 and older. It takes into account the unique tax provisions and deductions relevant to this age group, making tax filing a breeze for seniors.

For our wonderful senior citizens out there, the IRS has introduced Form 1040-SR. This form is specifically tailored to meet the needs of taxpayers aged 65 and older. It takes into account the unique tax provisions and deductions relevant to this age group, making tax filing a breeze for seniors.

Well, folks, that wraps up our quick tour of some of the key IRS forms you may come across during tax season. Remember to consult with a tax professional or use reputable tax software to ensure accurate completion of your forms.