Good day, fellow Asian friends! Today, we have some valuable information to share with you regarding Form 1099. We understand that tax forms can be daunting, but fear not! We are here to assist you and provide you with all the necessary details in a concise, easy-to-understand manner.

1099 2023 Form - Editable PDF

Let’s start with the 1099 2023 Form, which comes in an editable PDF format. This form is widely used for reporting various types of income, such as self-employment earnings, interest, dividends, and rent. It is essential for individuals and businesses to accurately fill out this form and submit it to the Internal Revenue Service (IRS) to ensure compliance with tax regulations.

Let’s start with the 1099 2023 Form, which comes in an editable PDF format. This form is widely used for reporting various types of income, such as self-employment earnings, interest, dividends, and rent. It is essential for individuals and businesses to accurately fill out this form and submit it to the Internal Revenue Service (IRS) to ensure compliance with tax regulations.

What the 1099-NEC Coming Back Means for your Business

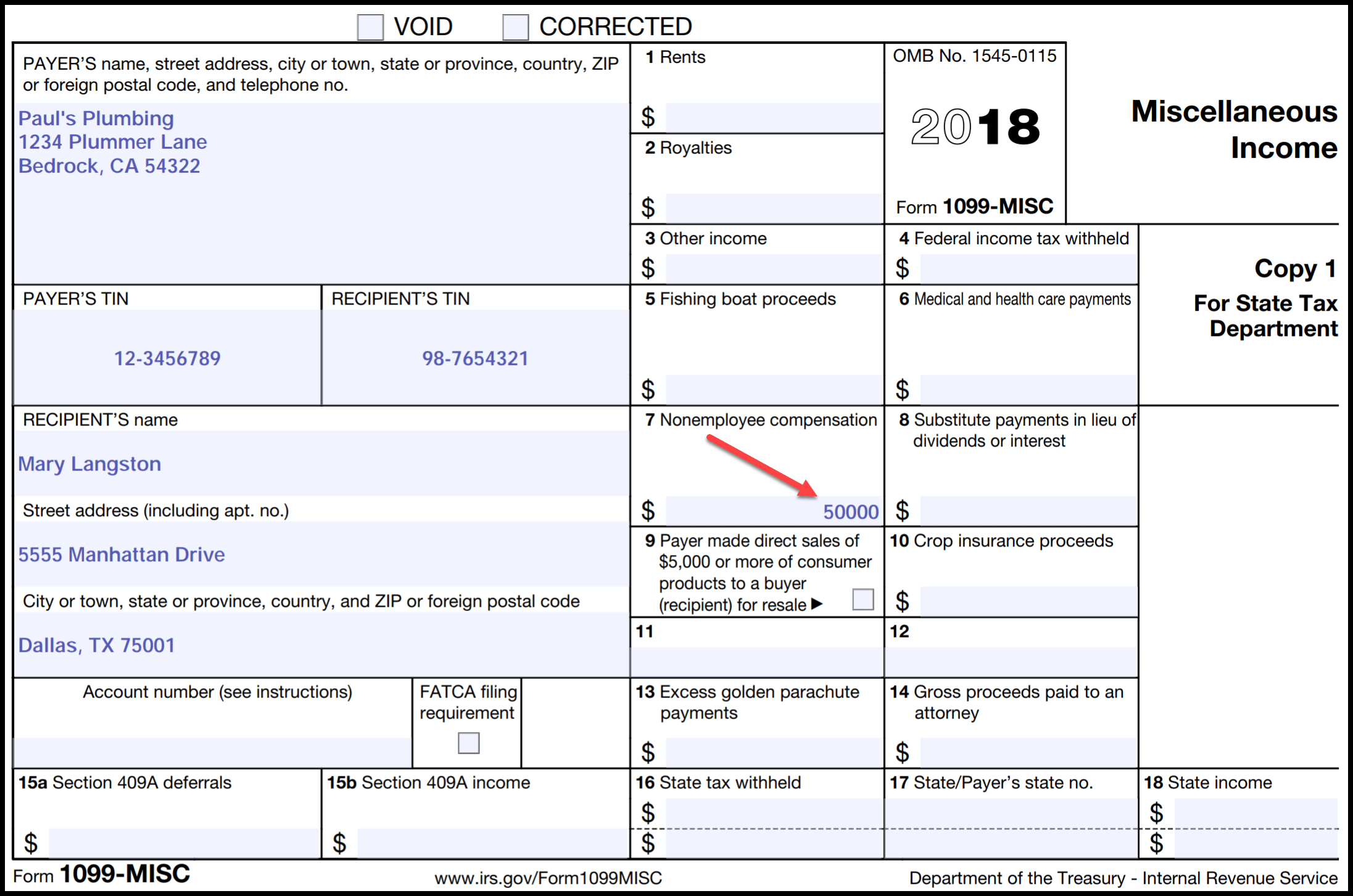

The reintroduction of the 1099-NEC form holds significance for businesses. It specifically addresses the reporting of non-employee compensation and replaces the use of Box 7 on the 1099-MISC form. The return of the 1099-NEC streamlines the reporting process, making it easier for businesses to manage their tax obligations accurately.

The reintroduction of the 1099-NEC form holds significance for businesses. It specifically addresses the reporting of non-employee compensation and replaces the use of Box 7 on the 1099-MISC form. The return of the 1099-NEC streamlines the reporting process, making it easier for businesses to manage their tax obligations accurately.

1099 Form 2020 📝 Get IRS Form 1099 Printable Blank PDF: Online Tax Form

Are you looking for a printable blank PDF of the IRS Form 1099? Look no further! You can easily obtain this form online, enabling you to report your income accurately. Whether you are an independent contractor, freelancer, or business owner, the 1099 form is a crucial document that helps you stay compliant with tax laws.

Are you looking for a printable blank PDF of the IRS Form 1099? Look no further! You can easily obtain this form online, enabling you to report your income accurately. Whether you are an independent contractor, freelancer, or business owner, the 1099 form is a crucial document that helps you stay compliant with tax laws.

What Is a 1099 Form, and How Do I Fill It Out?

The 1099 form plays a significant role in the U.S. tax system. It is used for reporting various types of income, such as self-employment earnings, interest, dividends, and more. Filling out the 1099 form correctly ensures that you comply with tax regulations and accurately report your income to the IRS. Let us guide you through the process!

The 1099 form plays a significant role in the U.S. tax system. It is used for reporting various types of income, such as self-employment earnings, interest, dividends, and more. Filling out the 1099 form correctly ensures that you comply with tax regulations and accurately report your income to the IRS. Let us guide you through the process!

2020 W-9 Form Printable | Example Calendar Printable

Business owners, have you heard about the 2020 W-9 form? This printable form is used to request taxpayer identification information from individuals and companies you engage in business with. By obtaining the necessary information through the W-9 form, you ensure compliance with IRS regulations and maintain accurate records for reporting purposes.

Business owners, have you heard about the 2020 W-9 form? This printable form is used to request taxpayer identification information from individuals and companies you engage in business with. By obtaining the necessary information through the W-9 form, you ensure compliance with IRS regulations and maintain accurate records for reporting purposes.

1099 Form 2020 📝 Get IRS Form 1099 Printable Blank PDF: Online Tax Form

Another resource available for obtaining a printable and blank PDF of the IRS Form 1099 is through an online tax form service. This convenient option allows you to access the form anytime, anywhere, and fill it out according to your specific income reporting requirements. Simplify your tax filing process with ease!

Another resource available for obtaining a printable and blank PDF of the IRS Form 1099 is through an online tax form service. This convenient option allows you to access the form anytime, anywhere, and fill it out according to your specific income reporting requirements. Simplify your tax filing process with ease!

Are You Ready for the 1099-NEC?

The 1099-NEC is making a comeback, and it’s crucial to be prepared. This form is designed to report non-employee compensation, and businesses need to ensure they comply with the updated regulations. Being well-prepared and familiarizing yourself with the requirements will save you time and stress when it comes to tax time.

The 1099-NEC is making a comeback, and it’s crucial to be prepared. This form is designed to report non-employee compensation, and businesses need to ensure they comply with the updated regulations. Being well-prepared and familiarizing yourself with the requirements will save you time and stress when it comes to tax time.

Memo - For 2020, 1099-NEC Replaces 1099-MISC For (NEC) Non-Employee

In 2020, the 1099-NEC form replaced the NEC section previously reported on the 1099-MISC form. This change streamlines the reporting process, ensuring that non-employees receive accurate documentation for their tax filings. By understanding this shift, you can keep your records up to date and comply with the latest IRS guidelines.

In 2020, the 1099-NEC form replaced the NEC section previously reported on the 1099-MISC form. This change streamlines the reporting process, ensuring that non-employees receive accurate documentation for their tax filings. By understanding this shift, you can keep your records up to date and comply with the latest IRS guidelines.

TSP 2020 Form 1099-R Statements Should Be Examined Carefully

As you receive your TSP 2020 Form 1099-R statements, it is crucial to examine them carefully. These statements provide information about your distributions, including withdrawals and rollovers from your Thrift Savings Plan (TSP) account. Accurately reviewing your Form 1099-R ensures that you report your income accurately when filing your taxes.

As you receive your TSP 2020 Form 1099-R statements, it is crucial to examine them carefully. These statements provide information about your distributions, including withdrawals and rollovers from your Thrift Savings Plan (TSP) account. Accurately reviewing your Form 1099-R ensures that you report your income accurately when filing your taxes.

What Is Form 1099-MISC? When Do I Need to File a 1099-MISC?

The Form 1099-MISC is an essential tax document used to report various types of miscellaneous income. You need to file this form when you make payments for services performed by someone who is not your employee. By understanding the requirements and deadlines associated with Form 1099-MISC, you can fulfill your tax obligations accurately.

The Form 1099-MISC is an essential tax document used to report various types of miscellaneous income. You need to file this form when you make payments for services performed by someone who is not your employee. By understanding the requirements and deadlines associated with Form 1099-MISC, you can fulfill your tax obligations accurately.

We hope that this comprehensive guide has provided you with a better understanding of various Form 1099 types, their significance, and how to navigate through the process. Remember, accurate reporting and compliance with tax regulations are essential for individuals and businesses alike. If you require further assistance, we recommend consulting with a tax professional to ensure you meet all your tax obligations.

Until next time, stay informed and take charge of your financial responsibilities!