In today’s digital age, there is an abundance of information available at our fingertips. From social media posts to blog articles, we are constantly bombarded with content from various sources. One particular type of content that has gained popularity among traders and investors is the use of candlestick patterns.

Understanding Candlestick Patterns

Understanding Candlestick Patterns

Candlestick patterns are graphical representations of price movements in financial markets. They provide valuable insights into market sentiment and can be used to predict future price movements. These patterns originated in Japan and have been used for centuries in the analysis of rice trading.

There are numerous candlestick patterns, each with its own unique characteristics and interpretations. Some of the most common patterns include doji, hammer, engulfing, and shooting star. Each pattern is formed by a combination of open, high, low, and close prices, and it depicts the battle between bulls and bears in the market.

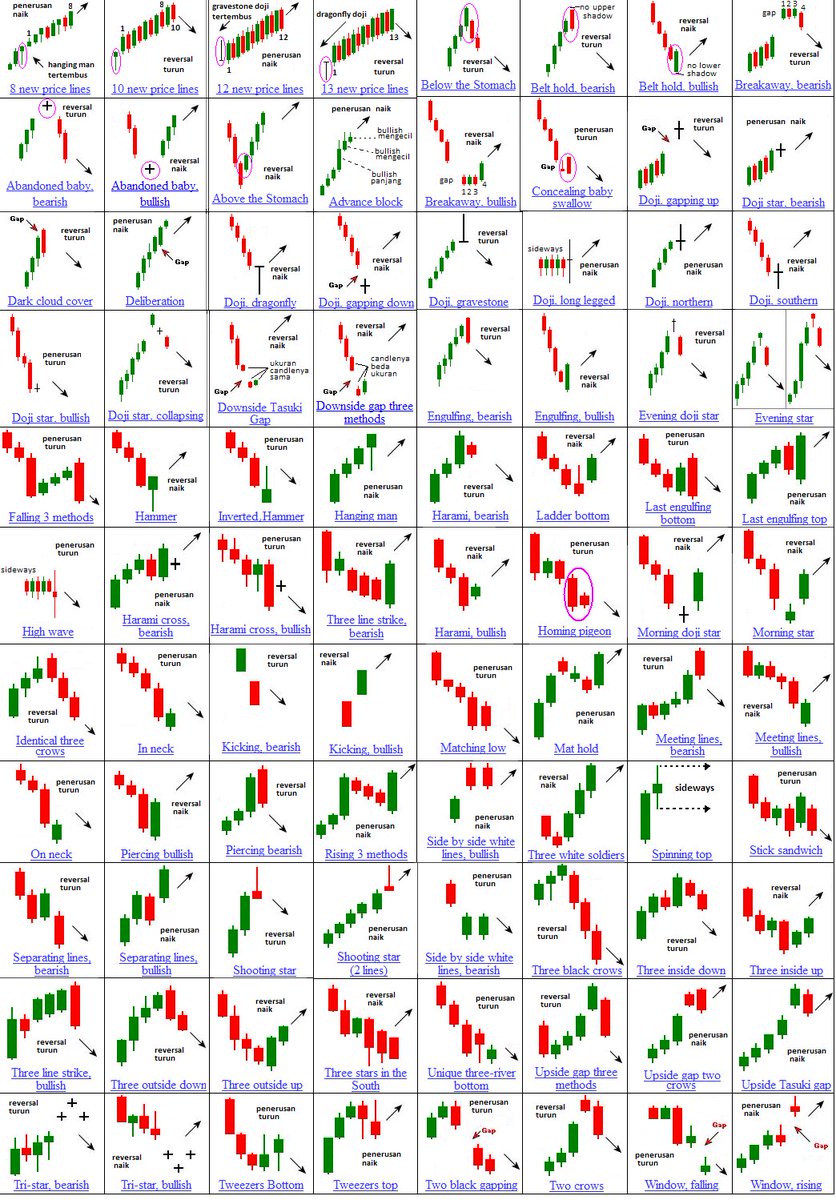

![Japanese Candlestick Patterns In a Nutshell [Cheat Sheet Included]](https://d24hlokhosw6ds.cloudfront.net/wp-content/uploads/2020/10/Screenshot-2020-10-19-at-09-4-2.png) Japanese Candlestick Patterns

Japanese Candlestick Patterns

Japanese Candlestick Patterns are widely used by traders around the world due to their effectiveness in predicting market trends. A cheat sheet, like the one provided in the image, can be a valuable tool for traders to quickly identify and understand these patterns. It serves as a handy reference guide, enabling traders to make informed decisions based on the prevailing candlestick patterns.

Some of the key patterns highlighted in the cheat sheet include the doji, which represents indecision in the market, and the evening star, which signifies a potential reversal. By recognizing these patterns, traders can increase their chances of making profitable trades.

Candlestick Patterns Cheat Sheet

Candlestick Patterns Cheat Sheet

For those looking to delve deeper into candlestick patterns, a comprehensive guide can be an invaluable resource. The cheat sheet showcased in the image offers an in-depth analysis of various candlestick patterns, providing explanations and illustrations of each pattern.

As a trader, having access to such a guide can greatly enhance your understanding of candlestick patterns and the signals they generate. It allows you to spot potential trading opportunities and manage your risk more effectively. By combining technical analysis with candlestick patterns, traders can develop a well-rounded approach to their trading strategies.

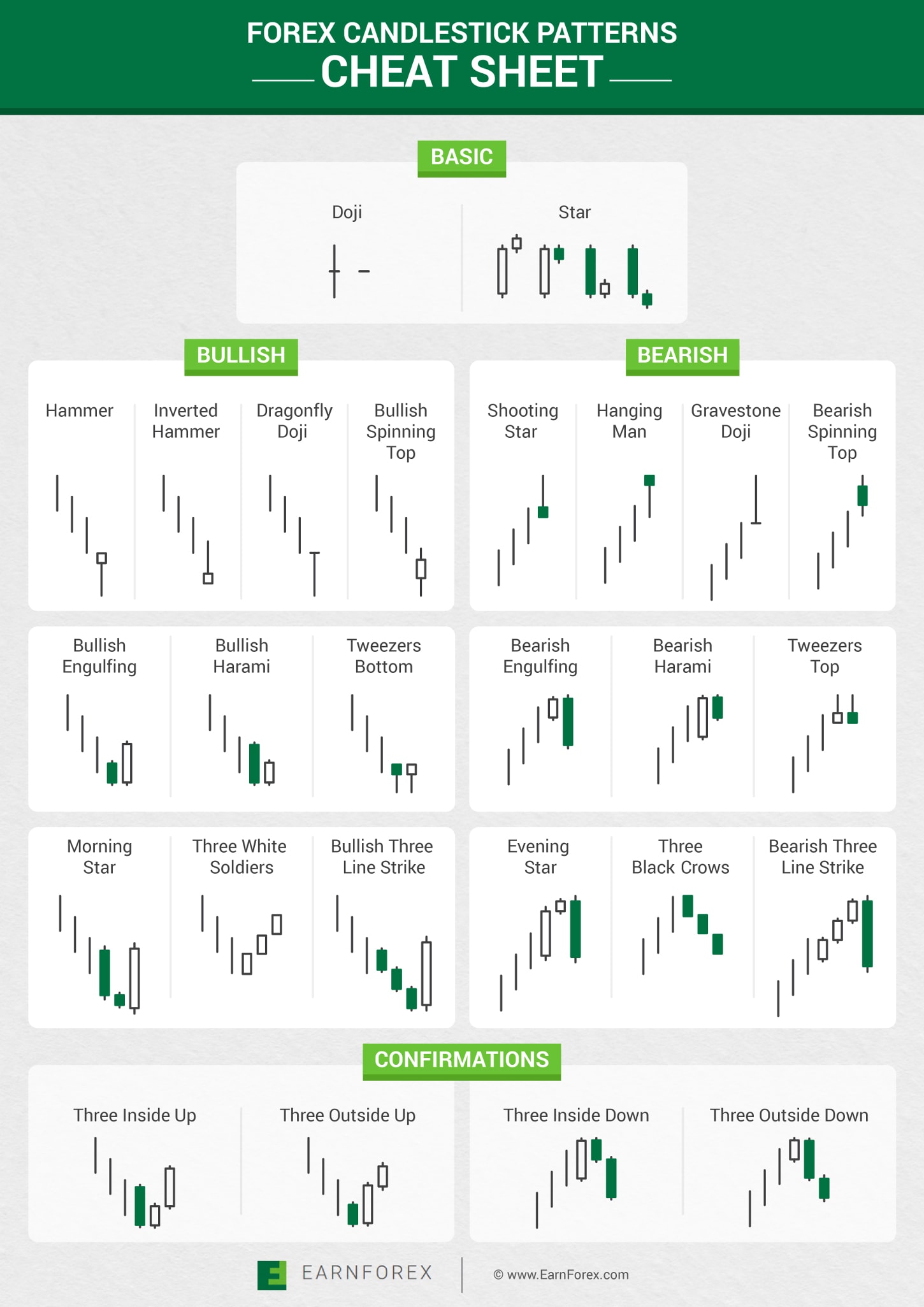

Forex Candlestick Patterns

Candlestick patterns are not only limited to stock markets but also find application in the forex market. The cheat sheet in the above image focuses specifically on candlestick patterns in the forex market. The forex market operates 24 hours a day, allowing traders to take advantage of various patterns that emerge throughout the day.

By understanding these patterns, forex traders can identify key reversal points and potential market trends. This knowledge can be used to develop effective trading strategies and increase the probability of successful trades.

Different Types of Candlestick Patterns

Different Types of Candlestick Patterns

In the world of candlestick patterns, there are numerous types of candles that can be formed. Each type has its own significance and provides valuable insights into market movements.

For example, a bullish engulfing pattern is formed when a small bearish candle is followed by a larger bullish candle. This pattern indicates a potential reversal in the market sentiment and suggests that the bulls are gaining control over the bears.

On the other hand, a shooting star pattern is formed when the price opens higher, trades significantly higher, and then closes near its open. This pattern suggests a potential reversal in the market, as it indicates that the bears are gaining control over the bulls.

By learning to interpret these different types of candles, traders can gain a better understanding of market dynamics and make more informed trading decisions.

Remember, candlestick patterns are not foolproof and should be used in conjunction with other technical analysis tools and indicators. It’s essential to consider other factors such as market trends, support and resistance levels, and volume before making any trading decisions.

Whether you are a seasoned trader or just starting your journey in the world of finance, candlestick patterns can be a valuable tool in your trading arsenal. By understanding these patterns and incorporating them into your trading strategies, you can increase your chances of success in the financial markets.

So, the next time you come across a candlestick pattern cheat sheet like the ones shown in the images, take a moment to study them and learn how to leverage this powerful tool for your trading endeavors.