Asian people have always played a significant role in shaping the world economy and contributing to various industries. One crucial aspect that affects everyone’s life, including Asians, is taxes. Taxes are an essential part of every individual’s financial responsibilities, and it is crucial for everyone to understand the process. In this post, we will discuss a vital form called the W4 Form and provide valuable information for Asian individuals navigating the tax system.

W4 Form - A Complete Guide

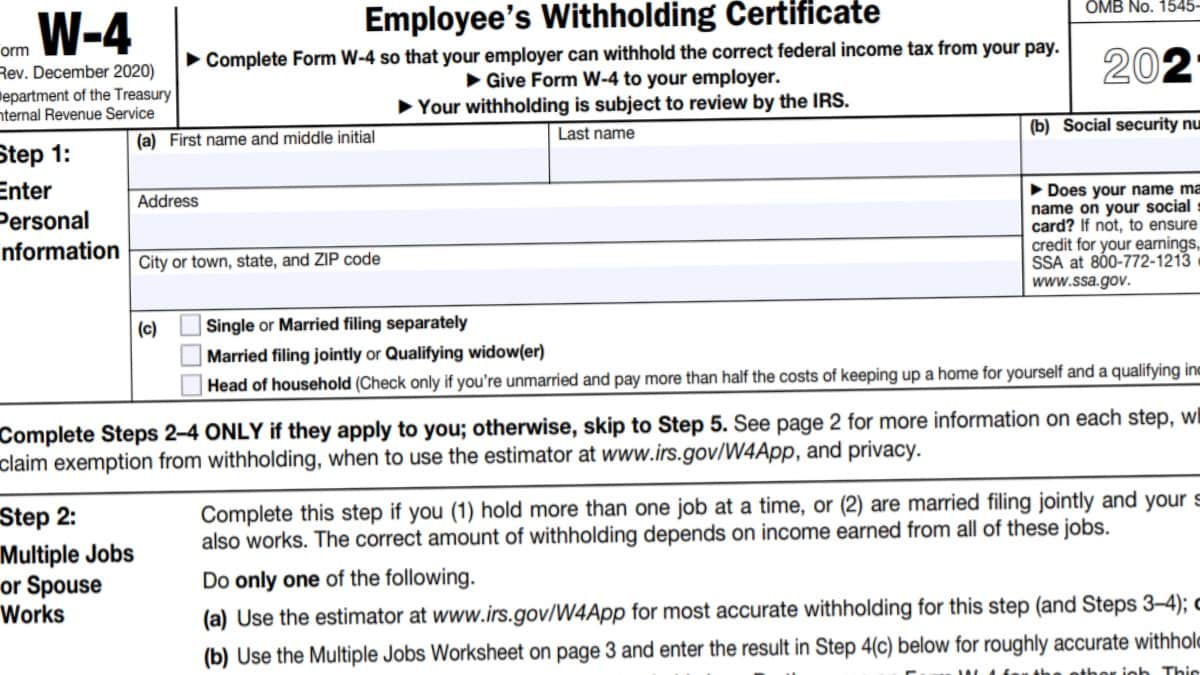

One of the essential documents related to taxes is the W4 Form. It is a form that employees fill out to inform their employers about their tax withholding preferences. By completing the W4 Form correctly, individuals can ensure that the appropriate amount is deducted from their paycheck for federal income tax purposes.

One of the essential documents related to taxes is the W4 Form. It is a form that employees fill out to inform their employers about their tax withholding preferences. By completing the W4 Form correctly, individuals can ensure that the appropriate amount is deducted from their paycheck for federal income tax purposes.

Understanding the W4 Form

The W4 Form might appear confusing at first, but with the right guidance, it becomes easier to understand. The form consists of various sections where individuals must provide their personal information, such as name, address, Social Security number, and filing status. It is essential to fill out these sections accurately to avoid any discrepancies in tax withholding.

The W4 Form might appear confusing at first, but with the right guidance, it becomes easier to understand. The form consists of various sections where individuals must provide their personal information, such as name, address, Social Security number, and filing status. It is essential to fill out these sections accurately to avoid any discrepancies in tax withholding.

Changes to the W4 Form

It is crucial to stay updated with the latest information regarding the W4 Form. The IRS periodically releases updated versions of the form to reflect any changes in tax laws. Staying informed about these changes ensures that individuals are filling out the form correctly. This not only helps in accurate tax withholding but also prevents any unnecessary complications during tax filing.

… Taxes are a significant aspect of every individual’s financial journey. Asian individuals, like anyone else, need to understand the process and fulfill their tax responsibilities effectively. By familiarizing themselves with the W4 Form and its requirements, Asians can ensure accurate tax withholding, minimizing any potential tax liabilities or complications. It is advisable to consult with a tax professional or utilize reliable online resources to clarify any uncertainties and ensure compliance with tax regulations.